Tax saving mutual funds are just like any other mutual funds with the added bonus that investments made in them are eligible for tax benefits under section 80C. Most of the tax saving mutual funds are ELSS schemes and make investments in equity markets.

LSS schemes tend to come with a lock-in period of 3 years, which means that the investment cannot be withdrawn for till the end of that time. If the investment is being made in monthly instalments (SIP) then the lock-in period for each instalment is 3 years. For example, if the first investment was made on the 1st of Jan 2015 and the second one on 1st of February 2015 then on the 1st of January 2018 ONLY the first instalments will get unlocked. The second instalment will remain locked till the 1st of February 2018.

When it comes time to withdrawals, investors can see how many units have gotten unlocked and redeem them at the current NAV. The NAV (Net Asset Value) is the amount you will get for each unit. To make withdrawals, you will need to know the number of available units and submit a claim form to the mutual fund provider. They will credit the amount to your account as soon as it is processed.

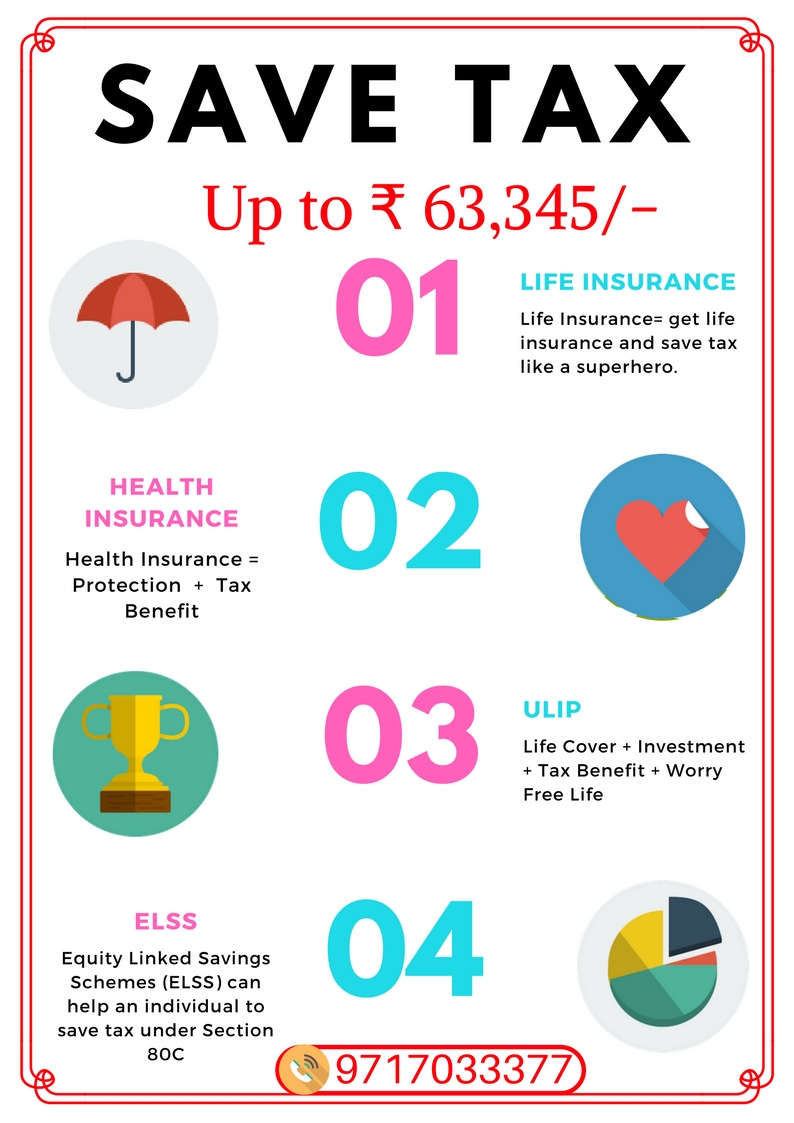

Tax planning is an analysis of a financial plan from a tax perspective. The purpose of tax planning is to ensure tax efficiency,

Finance Act, 2017 exempt income arising from the transfer of equity share (subject to certain exceptions) acquired on or after 1st October..

Maturity benefits are tax-free. However in cases where premium exceeds 20% of capital sum assured within a year,

Calculate your Tax Liability

As per the Indian Income-Tax Act, 1961, an annual tax is levied by the Government of India (GoI) on all income

| Fund Name | 1-Year Returns | 3-Year Returns | 5-Year Returns |

| Principal Tax Savings Fund | 13.5% | 13.9% | 20.75 |

| IDFC Tax Advantage (ELSS) – RP (G) | 20.2% | 12.6% | 21.4% |

| ABSL Tax Relief 96 – Direct (G) | 20.1% | 14.0% | 23.0% |

| L&T Tax Advantage – Direct (G) | 13.2% | 14.3% | 19.7% |

| HDFC Long Term Advantage (G) | 10.3% | 11.9% | 17.5% |

| DSP BlackRock Tax Saver Fund – Regular (G) | 7.6% | 12.2% | 19.5% |

| Kotak Tax Saver – Regular (G) | 4.8% | 8.7% | 16.3% |

| Invesco India Tax Plan – DP (G) | 18.0% | 13.4% | 22.1% |

| Reliance Tax Saver (ELSS) (G) | 0.7% | 6.2% | 19.4% |

| UTI LTEF (Tax Saving) – Direct – (G) | 8.3% | 8.9% | 15.0% |